New Pan Card

Delivery Options

Delivery Available on this location

Delivery Not Available on this location

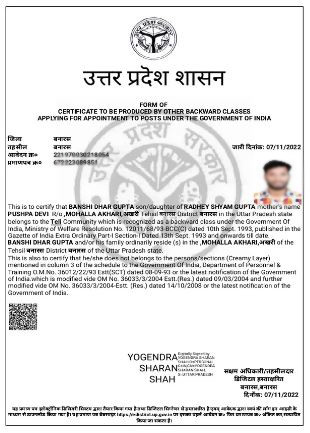

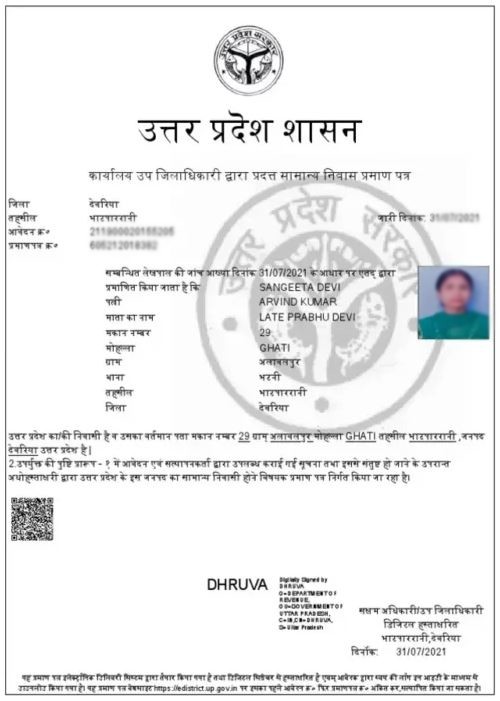

Requirement Important Documents

| for New Pan Card Apply |

ü Aadhar Card ü For Minor (Father Aadhar Card & Signature) ü Signature ü Photo (1) ü Father Name ü Mobile Number ü e-mail Id for receiving e-pan card ü Pan Card for Postal Address |

Description

Pan Card Delivered within 15 - 25 Days Provided by your Postal Address. Pan Card Slip Generate Within 24hrs. In case we have Facing any Technical issue in NSDL/UTI Website then your pan card processing are delay or maybe rejected. Pan card delivered at your address. In case address are incorrect and any issues for delivery so we are not responsible. If you are Provide any illegal documents like (editing etc.). Company are rejected your pan card application then we have not refund any amount and we are not responsible for any legal action. |

Benefits of Pan Card

A PAN (Permanent Account Number) card is a

unique identification number issued by the Indian Income Tax Department. It

serves various financial and legal purposes in India. Here are some key

benefits of having a PAN card:

1. Identity Proof

- PAN card is widely accepted as valid proof of identity

in various situations, such as opening a bank account, applying for loans,

or filing income tax returns.

2. Mandatory for Financial

Transactions

- PAN is required for certain financial transactions

above a specified limit, such as:

- Deposits of more than ₹50,000 in a bank.

- Purchase or sale of assets like immovable property

or vehicles.

- Investments in mutual funds, stocks, and insurance

premiums.

3. Filing Income Tax Returns

- PAN is mandatory for filing income tax returns. It

helps in tracking your financial history and ensures that taxes are paid.

4. Opening a Bank Account

- PAN is required for opening savings and current

accounts with banks.

5. Applying for Loans and

Credit Cards

- When applying for loans or credit cards, banks and

financial institutions use your PAN to verify your creditworthiness and

track your financial transactions.

6. Buying and Selling Property

- PAN is mandatory for transactions related to buying

or selling immovable properties exceeding ₹10 lakhs.

7. Investments in Mutual Funds

and Stock Market

- For investments in mutual funds or shares, PAN is

required to track investments and ensure compliance with regulations.

8. Foreign Currency Exchange

- When you need to exchange foreign currency for

amounts exceeding ₹50,000, a PAN card is required.

9. Preventing Tax Evasion

- The PAN card helps the Income Tax Department monitor

financial transactions and prevent tax evasion by linking all transactions

to a single identification number.

10. Receiving Payments

- Freelancers, consultants, or self-employed individuals

must provide their PAN to clients when receiving payments exceeding

₹30,000 in a single transaction to avoid TDS (Tax Deducted at Source)

without PAN.

11. Starting a Business

- PAN is necessary for registering a business entity,

opening a current account, and complying with tax regulations.

12. Claiming Income Tax

Refunds

- PAN allows individuals and businesses to claim

refunds on taxes if they have paid more than their tax liability.

13. Tracking Tax Payments

- The PAN system helps individuals track their tax

payments and records, making the taxation process more transparent.

Overall, a PAN card is essential for maintaining a

transparent and regulated financial system in India, and it offers numerous

benefits for both individuals and businesses.

Ph

d