Insurance

Delivery Options

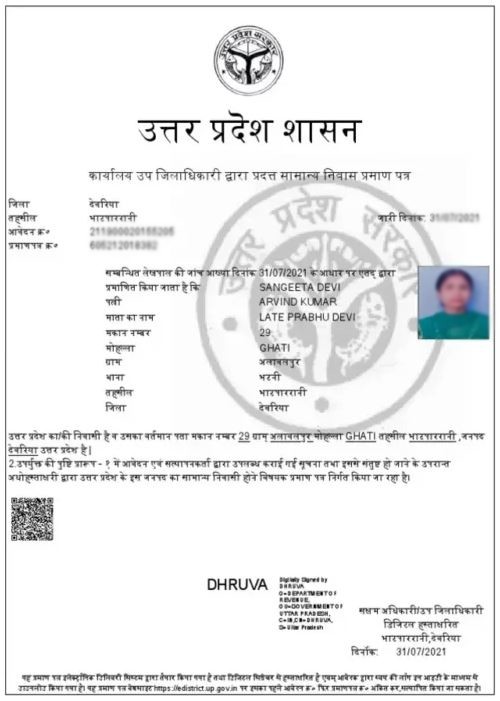

Delivery Available on this location

Delivery Not Available on this location

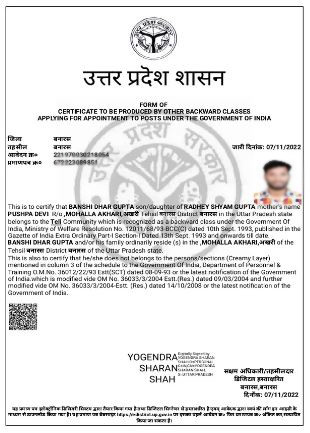

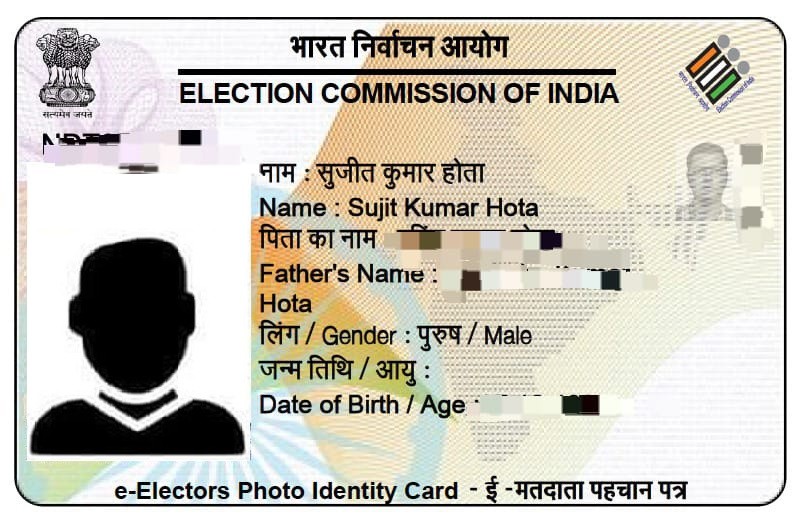

Requirements of Document

RC (Registration Certificate) Aadhar Card (Owner of Vehicle) Pan Card (Owner of Vehicle) Mobile Number Email ID Old Insurance (If Applicable) Nominee Name & DOB, |

Vehicle Insurance is a contract between a vehicle owner and an insurance company that provides financial protection against losses or damages to the vehicle or third-party liabilities arising from accidents, theft, natural disasters, or other unforeseen events. In exchange for a premium payment, the insurance company agrees to cover specific risks outlined in the policy.

Types of Vehicle Insurance

Third-Party Liability Insurance:

- Mandatory by law in most countries.

- Covers damages caused to a third party's property or injuries/death to third-party individuals.

- Does not cover damages to your vehicle.

Comprehensive Insurance:

- Covers both third-party liabilities and damages to your own vehicle.

- Includes protection against theft, natural calamities (floods, earthquakes), fire, vandalism, and accidents.

- Offers the option to add various riders for enhanced coverage.

Standalone Own Damage Cover:

- Covers damages to your vehicle only, not third-party liabilities.

- Useful if you already have third-party insurance.

Pay-As-You-Drive Insurance:

- Premium depends on the usage of the vehicle.

- Suitable for those who don’t drive frequently.

Key Features and Benefits

- Financial Protection: Reduces the financial burden of repair or replacement costs.

- Third-Party Coverage: Fulfills legal obligations and compensates third-party damages.

- Customizable Coverage: Add-ons like zero depreciation, roadside assistance, engine protection, etc.

- Personal Accident Cover: Covers injuries or death of the driver and sometimes the passengers.

Common Add-Ons

- Zero Depreciation Cover: Full claim without considering depreciation on parts.

- Roadside Assistance: Help in case of breakdowns.

- Engine Protection Cover: Covers engine damage due to waterlogging or other issues.

- Consumables Cover: Includes items like nuts, bolts, and lubricants in claims.

- No-Claim Bonus (NCB) Protection: Retains NCB benefits even after a claim.

Exclusions (What’s Not Covered)

- Regular wear and tear.

- Driving under the influence of alcohol or drugs.

- Unauthorized vehicle usage.

- Damages due to war or nuclear risks.

- Mechanical or electrical breakdowns.