Description

Service Process within 24 hrs.

Balance withdraw / KYC, within 7 - 30 Days.

Withdraw Balance Credit in your Bank Account, Provided by

EPFO Department.

KYC, within 7 - 30 Days

Balance Merge, at your present company within 7 - 30 Days.

Any other service related EPF timing as per work.

In case we have Facing any Technical issue in Website then

your EPF Service processing are delay.

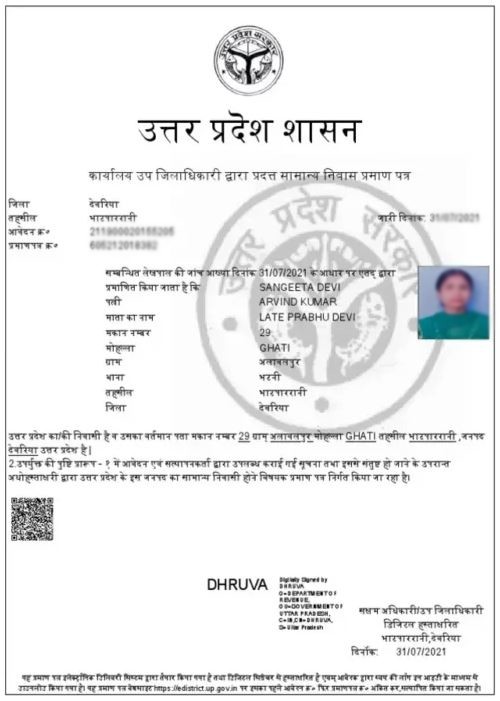

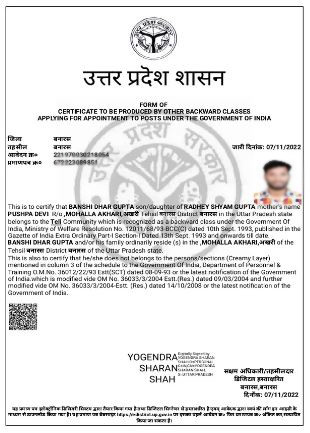

If you are Provide any illegal documents like (editing

etc.). Then we have not refund any amount and we are not responsible for any

legal action.

Benefits The Employees' Provident Fund Organization (EPFO) is a statutory body under the Ministry of Labour and Employment in India. It manages the Employees' Provident Fund (EPF), a retirement savings scheme for employees in India. Here are some key benefits of EPFO and the EPF scheme: 1. Retirement Savings- Mandatory Savings: Both the employee and employer contribute 12% of the employee's basic salary and dearness allowance into the EPF account every month. This provides a secure savings pool for retirement.

2. Interest on Savings- EPFO offers an interest rate on the EPF balance, which is declared annually. The interest earned is tax-free, making it a lucrative long-term investment.

3. Tax Benefits- Employee contributions to EPF are eligible for tax deductions under Section 80C of the Income Tax Act.

- The interest earned and the final corpus received at the time of withdrawal (after a continuous service of 5 years) are also tax-exempt.

4. Lifelong Pension (EPS)- Under the Employees’ Pension Scheme (EPS), employees are eligible for a pension after retirement, provided they have worked for at least 10 years. A portion of the employer's contribution (8.33%) goes into this pension scheme.

5. Partial Withdrawals- EPFO allows partial withdrawals for specific reasons such as:

- Medical emergencies

- Purchase/construction of a house

- Education or marriage of children

- Unemployment (after one month of unemployment)

- These withdrawals do not affect the tax benefits if the conditions are met.

6. Insurance Benefits (EDLI)- EPFO also provides an Employees’ Deposit Linked Insurance (EDLI) scheme, where employees are entitled to a life insurance cover without paying any premium. In case of the death of the employee, the nominee receives a lump sum amount up to ₹7 lakh.

7. Portability- The EPF account can be transferred when an employee changes jobs, and the Universal Account Number (UAN) ensures the smooth transfer of funds.

8. Loan Facility- EPFO members can avail loans from their EPF balance for purposes like housing, education, or medical needs, often with very low or no interest.

9. Support during Financial Crisis- During certain situations like the COVID-19 pandemic, the government has allowed special withdrawals from EPF to support employees facing financial hardships.

10. Online Access and UAN- EPFO services are digitized, allowing employees to access their EPF account details, transfer funds, and make withdrawals through the EPFO portal using the UAN.

These benefits make EPFO a crucial part of social security and financial planning for employees in India.

|